Sukanya Guha, Data Analyst, Registry Trust

Tuesday, 24th May 2022

In follow up to our CEO Lex Jones’ blog for #MentalHealthAwarenessweek, we are exploring the relationship between financial vulnerability and mental health, with a focus on Scotland.

Step Change Debt Charity’s recently published report, Scotland in the Red: A look at personal debt statistics in Scotland 2021, found that its Scottish clients’ average arrears on essential bills increased by 29% from £2,302 in 2020 to £2,961 in 2021.

As the not-for-profit organisation which maintains the Register of Judgments, Orders, and Fines, Registry Trust’s data supports millions of lending and credit decisions in the UK & Ireland every year and our regional data is an indicator of levels of financial vulnerability in different areas. Our monetary judgment statistics for the first quarter of 2022highlighted some concerning insights into consumer indebtedness and financial vulnerability in Scotland. While the number of consumer CCJs in England & Wales was 17% lower in Q1 2022 compared to Q1 2021, Scottish consumer debt decrees increased 9% from 2,914 in Q1 2021 to 3,175 in Q1 2022.

One of the most common contributing factors of debt among new Step Change clients is illness/disability, which affected about 16% of its clients in 2021. Using our data, we looked for a connection between the number of decrees in a region (and therefore levels of financial vulnerability) and the number of people facing mental illness or a disability in the same area.

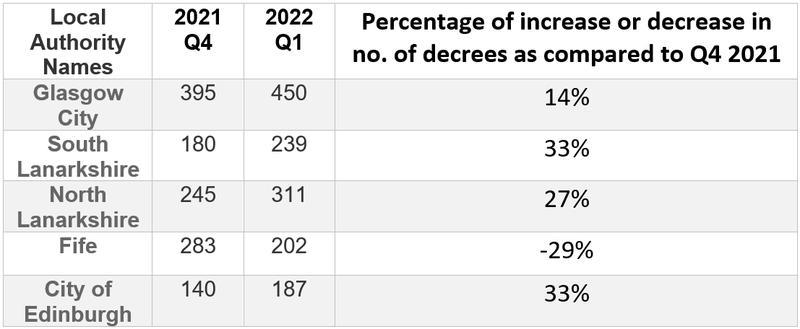

Our analysis shows that regions in Scotland with the highest number of consumer decrees in 2021 were:

- Glasgow City

- City of Edinburgh

- Fife

- North Lanarkshire

- South Lanarkshire

Among these, only Fife has shown a decrease in the number of consumer decrees in the first quarter of 2022 compared to the same period last year; the others have all shown a significant increase.

To explore the relationship between indebtedness and mental health in these areas, we consider the ONS population survey of 2021, which includes data on mental health conditions and disability.

Our analysis shows that the five areas with the highest proportion of the population with mental health conditions/disabilities in Scotland are the same as those with the highest number of consumer decrees. This supports Step Change’s data and conclusions.

Correlation is not causation, nonetheless this analysis confirms the relationship between mental health problems and problem debt/financial vulnerability cited by numerous scholarly articles and mental wellbeing support organisations (including Money and Mental Health Policy Institute). With the continuing ‘fall out’ from the Covid crisis, dramatically rising energy bills, historic inflation and other cost of living increases, we can expect the problem to get worse for those with mental health issues in particular. It is clear that additional financial support needs to be provided in regions where a large segment of the population struggles with mental health.

To keep up to date with the latest from Registry Trust, click here to subscribe to our monthly updates and/or follow us on Twitter and LinkedIn. You can also follow our public website TrustOnline on Facebook and LinkedIn for regular useful updates about CCJs, credit scores and more.