Sukanya Guha, Data Analyst, Registry Trust

Tuesday, 30th May 2023

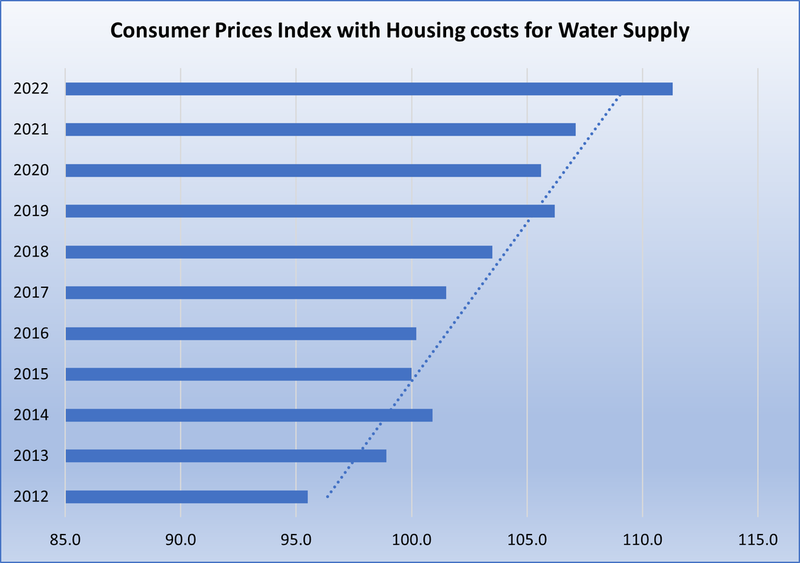

2022 has already seen consumer struggles due to the of the cost-of-living crisis. Reports of a 7.5% increase in water bills from April 2023 will likely add to the existing challenges for consumers (hikes will vary across the UK). To understand the impact of the upcoming increase of water supply prices on consumers, we have looked at Consumer Prices Index with Housing costs (CPIH) for Water Supply. CPIH is the Consumer Prices Index including owner occupiers’ housing costs and it is the UK’s leading measure of inflation. The graph below shows the CPIH index for Water supply over the years, which has been the highest in 2022.

Data Source: ONS

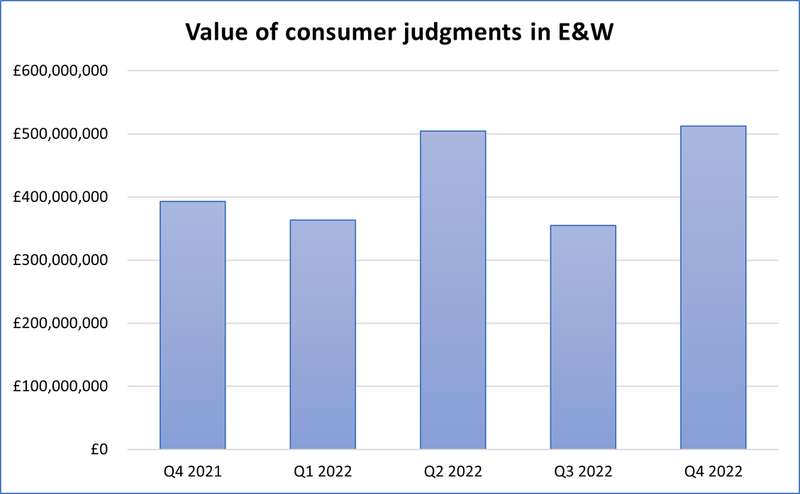

Our analysis of the consumer CCJ data for the last quarter of 2022 data has seen a year-on-year increase of 31% in the total value of consumer judgments as seen on the graph below.

Data Source: Registry Trust Limited

Further increase in water bills will likely have a negative impact on the consumers who are already struggling with debt. But the absence of claimant data for England and Wales makes it difficult to understand the impact on consumer debt which is caused by the price rise in any specific sector.

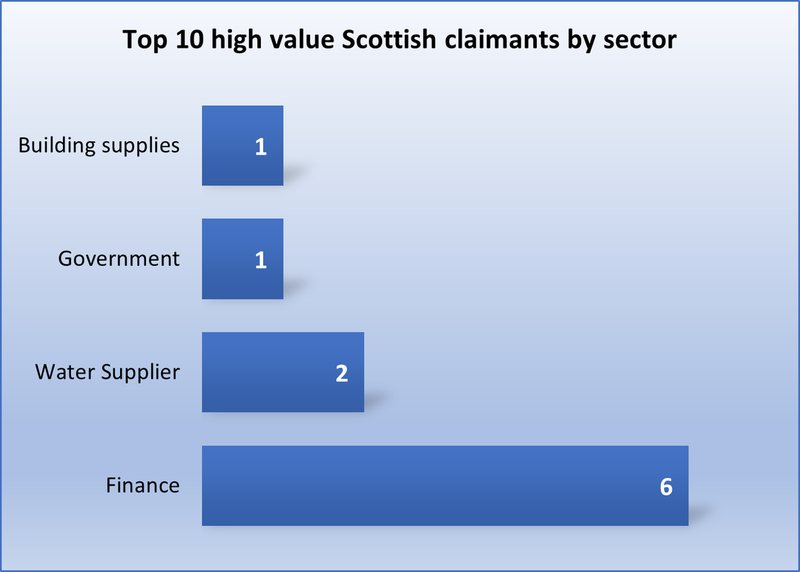

Registry Trust’s recent analysis of Scottish claimant data for 2022 has seen that out of the top 10 claimants who have the highest value of debt for judgments entered, two are water suppliers, as seen in the graph below.

Data Source: Registry Trust Limited

Even though Scottish judgment data comprises only 2% of the total judgment data held by Registry Trust, having access to it provided us the opportunity to identify the claimants who are representative of a significant amount of debt.

Also, analysis of Northern Ireland claimant data for 2022, which comprises only 0.55% of the total judgment data, shows that the fifth highest value of judgments was claimed by a water supplier in that jurisdiction.

England and Wales are responsible for 96% of the total judgment data held by Registry Trust. Having access to the claimant data for these jurisdictions will add value to, and increase actionable insight from, the analysis of the level of debt claimed by different sectors in England and Wales. Completing this data set is a win from a variety of aspects including analysis that will successfully drive data driven decision making across numerous sectors both public and private.